In almost every overseas Filipino worker story, having the ability to purchase and own your dream home is a sign of success. The type of home purchased and how it serves to the OFW homebuyer are more indicators of the “sikap at tiyaga” they poured into whatever job or jobs he or she has done abroad.

But a major complaint among OFWs is their ability, and for some, their lack of know-how when it comes to buying a home in the Philippines. But, newsflash, this is not a common problem. This is perhaps a commonality, especially with first-time homebuyers.

With the help of the real estate developer behind OFW-friendly residential development Ironwood Estates, we compiled nine (9) essential tips when investing in your dream home in the Philippines:

1. Conduct a self-assessment.

Just as we advise homebuyers in the Philippines, you, as an OFW, should not be excused when it comes to buying a condo, townhouse, or house and lot the SMART Way.

Having more than enough money for a deposit on your next home doesn’t also mean that you are ready to buy one, either. Being able to evaluate your life plans will help guide you in your decision-making as you go through the homebuying process.

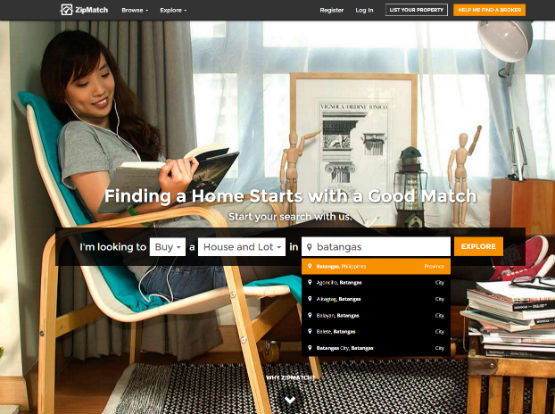

2. Do your own home and broker research.

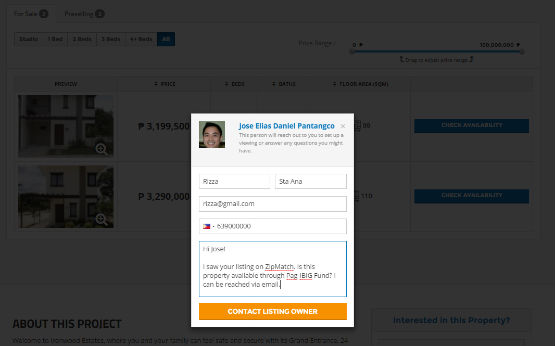

Real estate platforms online allow homebuyers to conduct a home search (including making the first contact with brokers) remotely.

Based on your property preferences, a real estate platform will provide comprehensive information and availability about a particular residential development, say a house and lot in Batangas, according to your online search preferences.

If you’re considering to invest in a house and lot in the countryside, for example, word of mouth dictates you should be looking for homes in Cavite or Laguna. But doing your research online eventually lead you to an alternative property in an underrated location that serves your family’s needs (or more!).

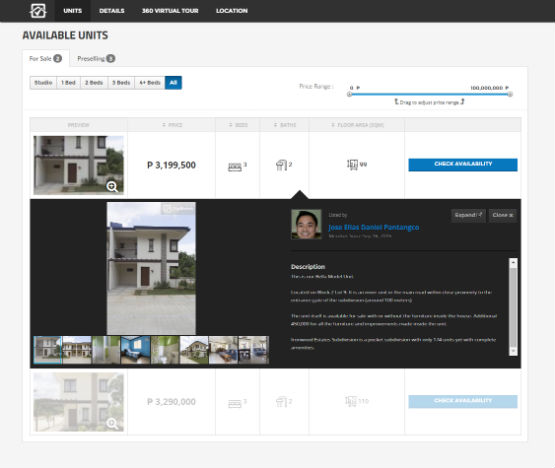

3. Take an active part in narrowing down your home choices.

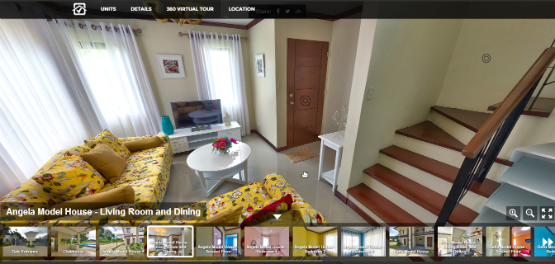

If you are a visual thinker, property viewings or “trippings” are a great way to determine which from your property choices is “The One.” But how is this possible if you are miles away?

Interactive content like 360 Virtual Tours, for example, help address an OFW’s dilemma in scheduling property viewings with a broker, especially for those who cannot be physically there.

However, first mover-brokers are now adopting 360 Virtual Reality, a new technology that simulates the property viewing experience without needing to actually visit the property or go into a showroom.

OFWs now can either get in touch with a visiting broker abroad or attend OFW events and schedule a property viewing in virtual reality in order to move on to the next step in the homebuying process.

4. Elect someone who can best represent you during the homebuying process.

It is only natural for an OFW to assign his or her spouse, child, sibling, or a close member of the family to represent you in the homebuying transaction.

Make sure also that you arm your representatives with multiple photocopies of your passport, visa, IDs, and other personal identification documents.

Also, for both yours and your representative’s sake, make sure that the latter keeps you updated with the dealings between the broker. As such…

5. … Practice communicating with your broker and/or representative via email.

You’ll thank us for this later.

Email communication allows you to document every single thing in your conversation with your broker and/or representative, especially if you are already on the negotiation stage. This will also help you invoke written proof should your broker forgot to consider the 5% discount he offered to you, for example.

If you have to talk over the phone, take charge in doing the minutes of your conversation, and asked your broker to reply. Don’t make any decisions unless your broker/representative seconded to the minutes.

6. Make sure that terms of your negotiation also reflects on your homebuying contracts.

As an OFW, you would want to safeguard the working agreement between you (through your representative) and your broker.

Exercise due diligence by requesting and then reviewing the copy of every binding agreement in the homebuying process before you (through your representative) would sign it. If there are terms that are vague to you, ask your broker if there’s a way for them to explain and then attached it to the agreement as an addendum (additional document containing extra terms, conditions, and/or information succeeding to the main document).

7. Get your papers authenticated by the Philippine Consulate.

Consularization means getting all of your documents of proof authenticated by the Philippine Consulate of the country you are working in. Fees may vary, and are usually non-refundable. Consularized documents often come with a seal and red ribbon over it.

8. If you work in a country where English is not the official language, have your documents of proof translated in English and signed by your employer or HR.

This also rings true for documents that would serve proof of your earnings (ex. employment contract). You can provide photocopies of the original and the translated version as long as they are certified true and correct by your employer or HR.

9. If you have an existing local savings account, ask your representative to open a checking account for you.

Because you will be required to pay in postdated checks (PDCs), it’s easier (and quicker) to open a checking account under your existing bank details than opening a new one. Also, it is more likely that you already have set up bank notifications to keep tabs on your account expenses.

Don’t have an idea on what a perfect home for your family back home looks like? This countryside house and lot would be perfect for you.